âIf creating wealth by printing money is so easy, then why should any of us work?â Ron Paul and other Austrian economic thinkers have been asking that question but never getting an answer from the proponents of absurd Keynesian theory.

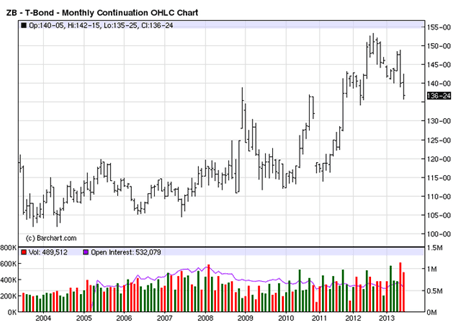

While those of us who believe that wealth is created through free market capitalism and not the activities of the state, market forces, which are the ultimate purveyor of truth in this four dimensional world may be about to hammer some sense into the dense heads of Keynesian communists like Paul Krugman and Ben Bernanke. I say that because there is growing evidence now that Bernanke may be losing control of the bond markets. And from there, he could ultimately lose control of the dollar.

Paul Volcker was a much more honest Fed chairman than the two that followed him. When asked how he knew what to do as Fed chairman, he said, âI simply followed the market.â Indeed that is a point that Bob Hoye has constantly been making. The Fed is never in charge, at least to the degree it seems to be or to the degree it wants you to believe it is. Our current policymakers want you to think they are the gods of the universe and that you should relinquish your freedom and autonomy to them.

But in fact, the long-term interest rates are not now cooperating with the Fed. And even the housing recovery, phony as it has been (artificial low rates, U.S. purchases of mortgages, and 80% of failed mortgages kept off the market by the banksters) may now be poised for another plunge into the earth if rates continue to rise.

Why are interest rates heading higher in light of a slowing economy not only in the U.S. but even more so around the world? A recent Treasury TIC report may be the âcanary in the coal mineâ that is providing a lethal answer. Here are some details that came out in the latest report dated June 14, 2013, which you can read at http://ow.ly/me0x5:

- Foreign residents decreased their holdings of long-term U.S. securities in April â net sales were $24.8 billion. Net sales by private foreign investors were $17.8 billion, and net sales by foreign official institutions were $6.9 billion.

- At the same time, U.S. residents increased their holdings of long-term foreign securities, with net purchases of $12.6 billion.

- Taking into account transactions in both foreign and U.S. securities, the net foreign purchases of long-term securities were negative $37.3 billion. After including adjustments, such as estimates of unrecorded principal payments to foreigners on U.S. asset-backed securities, the overall net foreign acquisition of long-term securities is estimated to have been negative $57.1 billion in April.

- Foreign residents decreased their holdings of U.S. Treasury bills by $15.1 billion. Foreign resident holdings of all dollar-denominated short-term U.S. securities and other custody liabilities decreased by $30.1 billion.

Jamie Dimon, JPMorganâs chairman, says the bank can make boatloads of money when interest rates go up. But as Rick Santelli recently asked on CNBC, âWho is funding Mr. Dimonâs book when Treasury rates rise?â because as they rise there will be huge losses at banks. Rick rightfully suggested that there will be huge losses at banks that are holding massive amounts of Treasuries that Mr. Bernanke printed money for them to buy that debt with. And this final statement in the last Treasury TIC report sums it up:

âBanksâ own net dollar-denominated liabilities to foreign residents increased by $99.9 billion.â

So while most of the world is running from the highly-rigged U.S. Treasury market because it is one of the dumbest investments any person could make, U.S. banks are still buying them up. Of course, when the banks lose money, they know they can always depend on the Fed to rob the American people either through âbail outsâ or âbail ins.â I will talk more about the upcoming âbail ins,â which threaten all of us, big time!

Jay Taylor

Jay Taylor Host of Turning Hard Times Into Good Times Jay Taylor is the host of Turning Hard Times Into Good Times on the VoiceAmerica Business Channel. The insights provided to Jay came from a history professor in 1967 who advised Jay that when countries go off a gold or silver standard, hard economic times are sure to follow because nations begin to think they do not need to work hard and save to enjoy a better life. Indeed there is no free lunch and a gold standard reminds people of that every day. Jay watched his professorâs prophetic words come true when in 1971, President Nixon completely detached the dollar from gold. Not surprising to Jay, the price of gold skyrocketed in the late 1970s as inflation wiped out vast amounts of wealth from average Americans. To protect his own wealth Jay began to invest in gold and gold mining shares and in 1981 he began sharing his success and insights in his newsletter. In 1981 Jay began writing a subscription newsletter that has earned his subscribers countless thousands of dollars over the years. Jayâs insights as to the real cause of our problems has enabled him to find investment strategies that work. Diagnose a problem correctly and you have a chance for success.