This post was written by David S. DuBose, Director of Supply Chain Solutions, Sedlak

This three-part series explores a number of near-term and long-term moves retailers can make to eliminate or minimize holiday season fulfillment headaches and ensure their supply chain is up to the task.

As noted in the previous posts in this series, retailers face several operative challenges during the holiday season. In Part 2, we discussed immediate actions to help retailers prepare for whatâs coming later this year and next. In this final section, we detail the additional, and more substantial, steps needed to build stronger operational capabilities to improve holiday season performance in future years.

Put in Place the Right Network Design

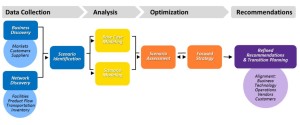

The most important thing a retailer can do is ensure it has the distribution capacities and infrastructure needed over the long term to support its growth goals and accommodate shifts in consumer demand and buying behavior. This involves taking a deep look at its network design to determine what changes it must make, and when, to be successful (see figure below).

Figure: High-level supply chain network design process:

The process begins with collecting the data required to forge a deep understanding of the companyâs existing supply chain network along two dimensions. The first involves the markets the retailer serves, the types of customers it sells to, and sources of supply. The second is more tactical, concerned with things such as product flow and transportation costs. This data provide insights into:

⢠The current state and capacity of the retailerâs stores, DCs and contracted facilities

⢠The operations and process within the stores and DCs

⢠The overall performance of the network, including costs and service levels

While itâs collecting data, the retailer also should discuss exactly what it will investigate from a network design perspective. For instance, the company could project an increase in compounded annual growth over the next five years driven predominantly by an expansion on the West Coast. It could contemplate a strategic shift to generate a much greater percentage of online sales and turn its physical stores into showrooms. Or it could launch a new store format in a new geographic area. Such conversations are critical to have at the outset of the process. They help define the scope of the effort, which ensures the retailer collects the right data and makes the right assumptions.

Once relevant data are collected, modeling and validation ensure that the data are as complete and accurate as possible. The output of this initial modeling is the base caseâthe existing network environment. A retailer can then begin to create possible scenarios to illustrate the resulting impact on network design. Adjusting various constraintsâincluding level and type of demand, merchandise mix, target customers, geographic location of customers, capacity, desired average cost, and service requirementsâ can determine which types and sizes of DCs and fulfillment nodes it would need, and where, to deliver the best business results.

After a retailer develops a number of prospective scenarios, a handful will typically rise to the top as the most desirable. The retailer further vets these finalists through additional sensitivity analysis, eventually determining the one that will best help the company achieve its business goals.

In the final step of the process, the retailer refines the chosen scenario to ensure it aligns with the overall business and its technology, operations, vendors and customers. Key elements of this exercise include:

⢠Reviewing transition planning and organization alignment (to understand what exactly is involved in moving from the current to future state)

⢠Sensitivity analysis (to determine how the move may impact other dimensions of the business)

⢠Risk analysis (to highlight how the new network design changes the retailerâs risk posture).

Addressing these factors enables the retailer to shape the final recommendation for a multi-year implementation plan designed to acquire the capacity (whether built or leased) to support the retailerâs projected growth over a 10-year horizon. It also provides formal objectives for key performance metrics, including revenue, service level, inventory, and transportation and fulfillment costs.

Implement Distributed Order Management Technology

Another important step retailers can take is embracing emerging Distributed Order Management (DOM) technology that can help them route orders more efficiently.

With more customers wanting to shop online, retailers increasingly are adopting an omnichannel focus to meet customer demands. In fact, according to Forrester Research, omnichannel will account for $1.8 trillion, or nearly 60 percent, of U.S. retail sales by 2018. But along with omnichannel comes an explosion in order replenishment complexity. A recent survey found that retailers maintain an average of four different selling channels to reach their customers. Yet, only 38 percent of them actually have the software to manage these channels, which helps explain their lackluster delivery performance last season.

Enter DOM. DOM software is designed to give retailers with complex order management processes a real-time view of inventory, order status, and location across their enterprise. It helps retailers with a significant direct-to-customer business choose the best fulfillment option for each order.

Being able to choose from multiple fulfillment options not only enables a retailer to effectively balance service levels and cost, it also can help take the strain off a DC during times of peak demand. DOM provides another measure of flexibility and speed for the supply chain to minimize disruptions that could disappoint customers.

However, to fully leverage DOM, a retailerâs stores must be capable of shipping orders to customers or enabling customers to pick up items they ordered onlineâsomething not all are set up to do. For example, a recent study found that nearly 40 percent of customers who chose to use a retailerâs “buy online, pickup in store” option have had challenges with store employees. The most common problem was that workers took too long to find orders in the store or system, or couldnât find them at all.

This study highlights a common challenge for retailers: Stores must have appropriate staffing to execute shipping from stores or have product picked and available for customer pick-up. This can be tricky: Ideally, store associates are on the floor providing great customer service and increasing sales, so the store manager has to balance who does the picking and fulfillment, and when, to avoid compromising front-of-the-house performance.

Furthermore, there are implications for the skill sets needed in store employees and advanced planning and scheduling of store labor to execute. Some of these issues can be mitigated by concentrating this fulfillment into a subset of well-prepared stores or adjusting the fulfillment promised time to reflect what can actually be executed.

DOM also is a major IT project. It requires replacing or augmenting the existing order management system, carefully thinking through how to set up the order routing and processing rules, and ensuring accurate inventory at the SKU-store level.

Deployment of DOM tools is currently not widespread. However, because of its substantial promise to help tackle complex omnichannel fulfillment, thatâs likely to change in the near future.

Manage Other Flow Options

Finally, retailers should take steps to aggressively manage other flow options that can take stress off the distribution network.

One option is exploring origin-based logisticsâi.e., value-added services that could be done at the factory and make downstream distribution easier. Store-ready pre-packs are one example. A pre-pack is an assortment of items that reflect different sizes and colors for a particular style. The pre-pack can be assembled at the factory so that the store or market receives an assortment that reflects what it needs. Pre-packs make it easier to move the received product to the store sales area; reduce costs by having offshore factory-based resources do the assembling instead of more expensive store employees; and, perhaps most important, give store employees more time to service customers.

One caveat with this approach: Creating pre-packs may require merchandise planning and allocation professionals to make their decisions earlier in the process. This runs counter to the preference of waiting as long as possible in order to get the most accurate read on market demand. The key, again, is striking the right balance between efficiency, responsiveness, and capacity.

In addition to origin-based logistics, retailers could employ DC bypass, in which all inventory of certain items needed for a store is consolidated at a separate facility and shipped directly to the store. Fashion retailers, for instance, can use DC bypass to handle their seasonal products while dedicating their DCs to their mainstream goods. In this way, the consolidation point acts as a ârelease valveâ that can relieve some pressure when the network is in danger of bogging down.

Conclusion

Thereâs no doubt the retail world has become much more complex, especially as customers increasingly demand omnichannel access to their favorite goods. The expanded âBlack Holidayâ selling season has only added to the challenges todayâs retailers must effectively manage to keep customers happy and still grow profitably. By taking the appropriate short- and long-term steps to identify and remove potential supply chain bottlenecks, retailers can make upcoming holiday seasons âblacker,â and less likely to be revisited by those unwelcome old ghosts.

photo credit: www.flickr.com Allen Scheffield