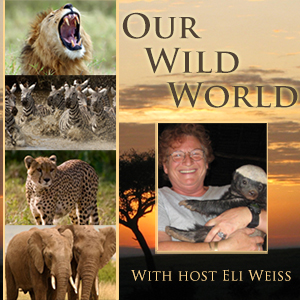

The Stock Market: Illegal Wildlife Trade Economics with Alejandro Nadal By Eli Weiss

Economics play a huge part in illegal wildlife trade. When we understand how macroeconomics...

Read Moreby VoiceAmerica | Dec 8, 2016 | Variety | 0 |

Economics play a huge part in illegal wildlife trade. When we understand how macroeconomics...

Read Moreby VoiceAmerica | Jan 8, 2015 | Business, Reviews, VoiceAmerica | 0 |

Longtime North Texas libertarian activist Ed Kless is more than the current Chair of...

Read Moreby VoiceAmerica | Dec 5, 2013 | Business, VoiceAmerica | 0 |

What does 2014 hold in store? For investors? For international business? For our 100th broadcast,...

Read More