From Challenge You Become Wise: Embracing Life’s Resistance

When speaking to Nicole Baldassarre, Director of Sales for InSpace, on my “Empowering Women...

Read Moreby Stephanie Duguid | Dec 18, 2023 | Empowerment, VoiceAmerica | 0 |

When speaking to Nicole Baldassarre, Director of Sales for InSpace, on my “Empowering Women...

Read Moreby Stephanie Duguid | Dec 11, 2023 | Empowerment, VoiceAmerica | 0 |

When speaking to Nora Miller, President of Mississippi University for Women, on my...

Read Moreby Stephanie Duguid | Nov 30, 2023 | Empowerment, VoiceAmerica | 0 |

When speaking to Dr. Janet Williams, Vice President of the School of Health Sciences at William...

Read Moreby Stephanie Duguid | Nov 13, 2023 | Empowerment, VoiceAmerica | 0 |

When speaking with Dr. Linda Garcia of the Center for Community College Student Engagement, on my...

Read Moreby Stephanie Duguid | Nov 2, 2023 | Empowerment, VoiceAmerica | 0 |

When speaking to Dr. Angela Robbins, founder of eLearingDOC, on my “Empowering Women in...

Read Moreby Bea Baylor | Oct 12, 2023 | Variety, VoiceAmerica | 0 |

Ultimately, the journey towards personal growth and self-discovery is a unique and individual one....

Read Moreby VoiceAmerica | Jan 12, 2022 | Business | 0 |

This week’s article is by Greg Moran, a C-level digital, strategy and change leadership executive...

Read Moreby VoiceAmerica | Oct 27, 2021 | Business | 0 |

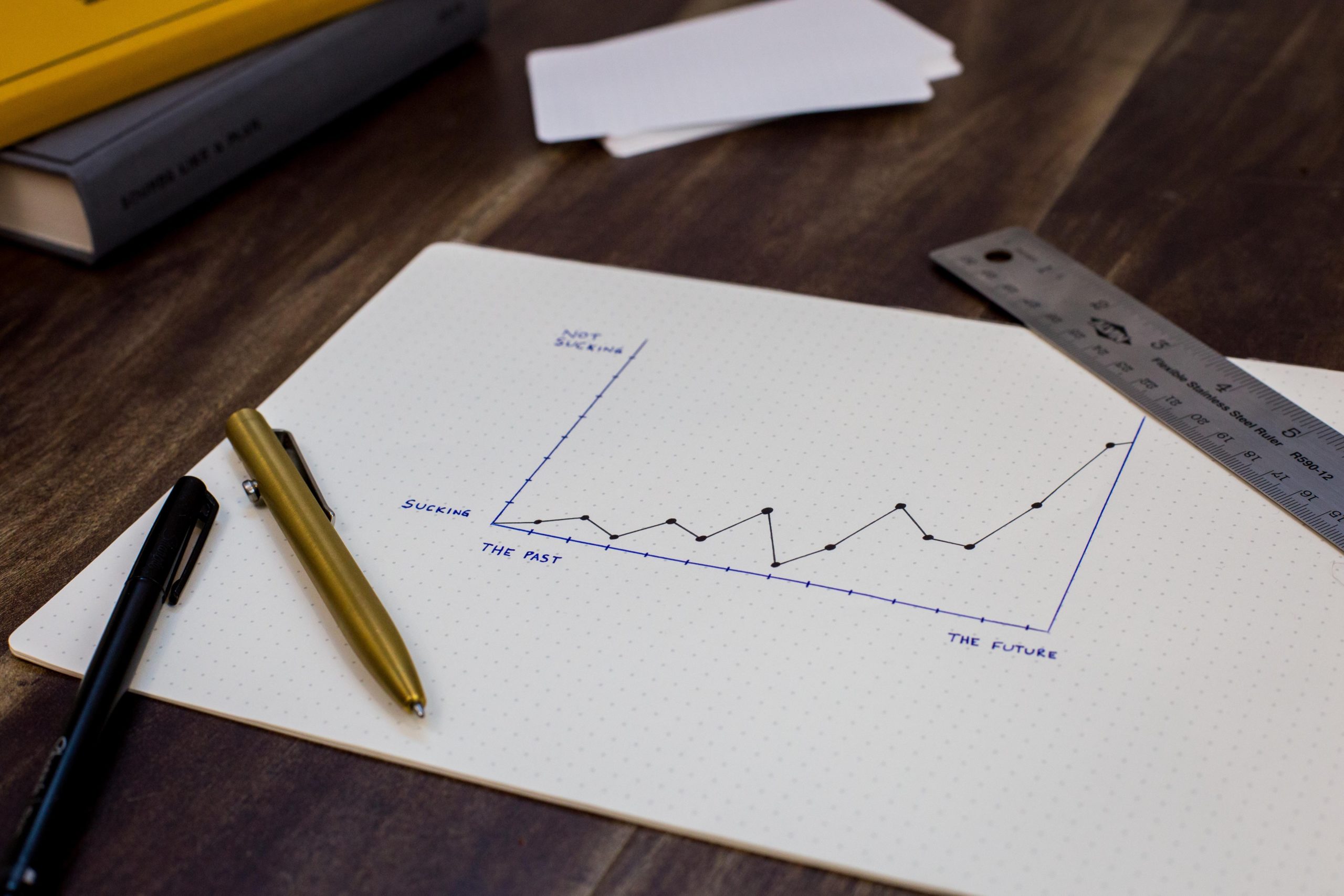

The number of businesses that fail in the United States is staggering. How does a business survive...

Read Moreby VoiceAmerica | Sep 30, 2021 | Business | 0 |

Looking into investing in the stock market? Here are some great tips for doing so. 1. Growth...

Read Moreby VoiceAmerica | May 24, 2017 | Empowerment | 0 |

Teens talk and the world listens every Tuesday NOON PT on the Voice America Kids Network....

Read Moreby VoiceAmerica | Jan 6, 2017 | Empowerment | 0 |

Being You and Growing Your Business! If you are asking for growth in your business this year, are...

Read Moreby VoiceAmerica | Oct 28, 2016 | Business | 0 |

âI donât know if youâre going to win, but I know youâll come out of this a better...

Read More